Decisive Moment Arrives With $4 Trillion Stocks Rally at Stake

(Bloomberg) -- Investors are facing a pivotal week as a key measure of inflation that hits Tuesday and the Federal Reserve’s interest-rate decision on Wednesday are expected to set the tone for the stock market and economy heading into 2024.

Growing speculation that the Fed is done hiking rates and will start cutting by mid-year is fueling a sharp drop in Treasury yields and rekindling investors’ risk appetite. The S&P 500 Index has added roughly $4 trillion in market value since late October, as traders rush into beaten-down areas of the market like small caps, which typically benefit from falling borrowing costs.

“Stocks have been rallying on optimism the Fed is done raising rates,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “The pricing has been rational considering how much the 10-year yields have dropped since mid-October. It seems like stocks will continue to grind higher as we enter 2024.”

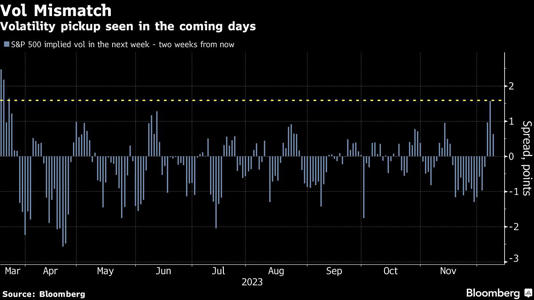

That said, a closer look reveals concerns about the week ahead. A measure of expected volatility in the S&P 500 for the next five trading sessions is surging relative to the subsequent five days. At one point this week, the gap reached the widest since March for such a period, signaling rising demand to hedge against turbulence.

Tuesday kicks off the one-two punch of crucial moments next week, with the release of November’s consumer price index. Signs of ebbing inflation could buoy shares into year-end by cementing expectations that the Fed will soon shift to easing. Consumer prices likely rose at a 3.1% annual pace, the lowest since June, according to a Bloomberg survey.

The next day, the central bank is projected to keep policy steady for the third straight meeting. With traders anticipating about a percentage point of total easing next year, they’ll be watching officials’ rate projections particularly closely as well as Chair Jerome Powell’s press conference.

The risk is that a sturdy economy keeps inflation high, pushing officials to consider another hike or to keep borrowing costs elevated for longer than hoped. That could weigh on rate-sensitive tech stocks that have driven much of the market’s gains in 2023.

“What Chair Powell says next week could change people’s minds, especially if he strikes a tone that’s more hawkish than what people are expecting,” Zaccarelli said.

The S&P 500 is up almost 20% this year, and closed Friday at the highest since March 2022. Traders are hoping that if bond yields are still generally heading lower, stocks are set up for broad-based gains heading into year-end. Since Oct. 19, the yield on 10-year Treasuries has fallen from nearly 5% to around 4.2% while the S&P 500 has risen almost 8%.

Yield Driver

History shows that big drops in bond yields are beneficial to the stock market.

Since 1980, there have been 33 instances in which 10-year Treasury yields fell 50 basis points or more within a month, according to data compiled by Christopher Cain at Bloomberg Intelligence. The median subsequent forward three-month return for the S&P 500 was nearly 8%, and for the Russell 2000 it was 8.2%.

“The nature of this bond rally is based on bets of more supportive Fed policy, which is favorable for stocks,” Cain said.

Retail investors appear to be buying into the enthusiasm. They picked up $6.8 billion worth of US stocks in the week through Wednesday, data compiled by JPMorgan Chase & Co.’s Peng Cheng show. That’s the largest weekly inflow since March 2022, when the Fed began its tightening cycle.

Meanwhile, many active managers who sat out this year’s rally are trying to make up for lost ground before the end of the year, creating even more stock-market momentum. Large-cap active funds struggled to keep up with last month’s rally, with just 41% beating their benchmark, data compiled by Bank of America Corp. show.

“A lot of people completely messed up in 2023,” said Vincent Deluard, director of global macro strategy at StoneX, noting that many investors expected a recession heading into the year. “It’s been a very hard year for active managers. A lot of people got the macro picture wrong.”

In : #WATCHLiST

Tags: decisive moment arrives with $4 trillion stocks rally at stake bloomberg